Types of MSME Loan

1. Micro enterprises Loan And

Government Schemes

Government Schemes

MEL is working capital loan to the micro enterprises. Micro Enterprise Finance is directed at small enterprises and individuals in rural and semi-urban areas to meet working capital and investment financing requirements in industries such as retail, wholesale, and trade. A micro-enterprise under this loan category is usually a small business engaged into manufacturing, trading or services.

MEL loan is provided up to 50,00,000

Loan tenure is upto 120 Months

Usually utilized for stocks, extending more credit or replacing trade credit and for replenishing working capital used for consumption

The interest rate for the product ranges up to 36%.

Facility to have limit based loans

2. Small enterprises Loan And

Government

Schemes

Government Schemes

Small scale enterprises are those industries where business is done on a small scale. As per the latest update the definition of a small scale enterprise is where the business has an annual turnover not exceeding 50 crores, while the investment on plant and machinery is not exceeding 10 crores. Each country has its own definition of what constitutes a small enterprise. SMEs play an important role in an economy, employing vast numbers of people and helping to shape innovation.

SME should have been profitable in the last 1 years

Annual Turnover and Profitability criteria shall be defined by the lender

The applicant firm can be a manufacturing unit, a sole proprietorship firm, partnership firm, or a public/private enterprise

Good credit score .

3. Medium enterprises Loan And

Government Schemes

Government Schemes

Medium enterprise having an investment in plant and machinery or equipment that is less than 50 crore rupees. The turnover does not go over two hundred and fifty crore rupees. A medium enterprise can likewise be engaged in manufacturing, services, or trading activities. the characteristics of medium-sized enterprise can be seen its financial management. They employ professionals in finance and hold a business license. Examples of medium enterprises are packaged food industry, bakery factories, and hardware stores. These businesses hire more employees.

MEL loan is provided up to 50,00,000

Loan tenure is upto 120 Months

Usually utilized for stocks, extending more credit or replacing trade credit and for replenishing working capital used for consumption.

The interest rate for the product ranges up to 36%.

Facility to have limit based loans

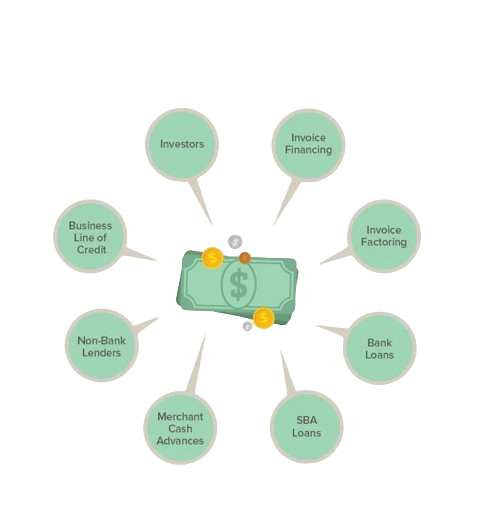

Benefits Of An MSME Loan

Utilizing the loan amount is the main reason for taking out a business loan for an MSME. The majority of MSME owners request for loans to cover operating costs like rent, purchasing equipment, recruiting staff etc. Since these kinds of purchases might be costly, the solution on this is better to take out a company loan rather than using your own funds.

The high interest rate is one of the reasons why companies are hesitant to take out loans. With their reasonable and appealing interest rates, MSME loans stand out from other types of loans. This type of loan is thought to be less risky than other loans, which is why the interest rate is so low. These loans have an interest rate between 10% and 15%.

Tax payments must be made on time by both individuals and organizations. Businesses or corporations receive an additional benefit of lowering their tax obligations through MSME loans. Entities can lessen firms' taxable revenue, which ultimately results in lower tax liabilities, by disclosing the MSME loan status on income tax filings.

Copyrights @ 2024 & designed by Novami Infotechs