We Are Innovating Finance For a New Era

MTS is a fast growing Financial Advisory, fundamentally involved in

offering the consulting services and the entire ground level assistance for all types

of corporate funding for medium and large size businesses. Having our Head Office at

Nashik, we have our branches at Aurangabad, Jalgaon and Mumbai.

Established in 2007, we have our official affiliation with all the Private

Sector Banks and NBFCs across India. Our USP lies in up to date knowledge about the

developments in Banking sector, strong team of dedicated and experienced

professionals, state of the art infrastructure and a strong good will with numerous

delighted clients.

17

Years ExperienceOur Missions

Our mission is to strategically plan and arrange the best possible funding options for our clients; taking into consideration the precise needs of the business. At the same time, we aim to maintain a mutually profitable and sustainable business model taking into consideration the overall interests of all our stake holders.

Our Vision

Our Vision is to expand across the geographies, continuously upgrade our abilities and competence & serve as a trusted single window avenue for all the financing needs in small, medium and corporate.

Dedicated Relationship Manager

Our dedicated relationship managers forge a strong bond with each customer, understanding their unique financial needs and aspirations. We provide tailored loan solutions that perfectly align with your goals and empower you for a brighter financial future.

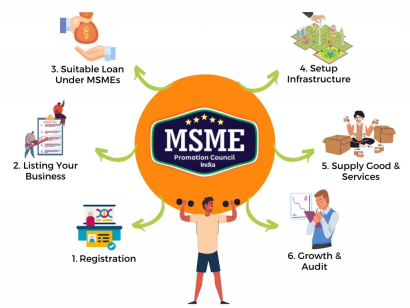

Financing The Backbone Of The Indian Economy

MTS supports MSME encompasses micro, small, and medium enterprises. MSMEs make up over 90% of all firms and account, on average, for 70% of total employment. In India, micro, small and medium-sized enterprises (micro SMEs) play an important role in the country's economic development. To provide credit facilities for the MSMEs, the Government of India has come up with many loan schemes, and even the banking sector and financial institutions grant loans to them.

More Details

News

ADB commits USD 2.6 billion in sovereign lending to India

Read More

Dipti Rokade

Copyrights @ 2024 & designed by Novami Infotechs.